Although your child may have heard the phrases cryptocurrency or Bitcoin, watched the glitzy cryptocurrency movies on TikTok, or talked about the topic with pals, they still may not completely understand what they mean. They could also be familiar with these concepts and eager to invest in digital currencies or use them to purchase goods or toys. Or they can be uninterested in cryptocurrency altogether.

Whatever the circumstance, it is your responsibility as a decent parent to assist your children in comprehending the complexity of the financial world. Understanding bitcoin may be crucial for kids since younger generations are already include it in their retirement planning, per the 2022 Investopedia Financial Literacy Survey.

According to Joyce Serido, associate professor and extension specialist in family social science at the University of Minnesota, who specializes in financial parenting, “teaching about money [nearly] starts at birth.” Children are better prepared to grasp cryptocurrency if they have a firm concept of how money and currencies are converted into value and purchasing power. She continues that youngsters may increase their inquiries about cryptocurrency and feel ready to utilize it around the time they reach adolescence.

Professor of accounting Vivian Fang, the resident crypto specialist at the Carlson School of Management at the University of Minnesota, says it will be some time before she starts educating her five-year-old son about cryptocurrency. She is teaching him about the importance of money till then by teaching him about winning and losing.

In addition to giving him a $5 weekly stipend, Fang also gives her son quarters in exchange for work done, such as one for doing the dishes and two for helping with the dog walk. If, for instance, he misbehaves at a swimming session, his parents may also impose losses in the form of a fine. Fang has observed her son’s development into a savvy shopper. Her son will either make a purchase or walk away after concluding an item is “too pricey,” operating under the premise of utilizing his own money. He’ll likely develop a strong interest in cryptocurrency in a few years, just like millions of older children do right now.

Say your youngster is prepared to start investing in cryptocurrencies. You may assist your child with their study by consulting dependable sources like Investopedia, which clearly defines cryptocurrency and discusses its advantages and disadvantages. Review social media sites like YouTube with one another as well. YouTube is a great resource for tutorial videos.

Don’t ignore TikTok because it’s popular with youngsters and you may utilize it as a teaching opportunity to go through its crypto movies with your class. The website has a ton of videos, some of which are from questionable influencers who make outrageous get-rich-quick claims and are interspersed with pictures of Ferrari and Rolls-Royce vehicles parked in front of opulent residences. You are assisting your youngster in separating trustworthy information from potentially harmful information by looking at various forms of information.

Why Use Crypto?

Cryptography is used to ensure the security of cryptocurrencies, which are decentralized digital currencies. Assist your youngster in realizing that cryptocurrencies might be employed for investments and to purchase necessities and experiences just like fiat, conventional currencies like US dollars and Mexican pesos. According to CoinMarketCap, there are more than 18,847 digital currencies with a market valuation of $1.95 trillion as of April 12, 2022.

The biggest by far is Bitcoin (BTCUSD), which was introduced in January 2009 by a person who is most likely Satoshi Nakamoto and will be valued more than $40,000 per digital currency as of April 12, 2022.

Before Bitcoin was established with security safeguards in place, the early digital products were simple to copy, which was a problem for digital currencies inherently.

Blockchain is essentially a distributed ledger that is maintained by a diverse computer network. Cryptocurrencies are not issued by a central body, making them potentially resistant to intervention from or manipulation by governments. Some cryptocurrency investments require traders to be at least 18 years old, while others have no such restriction. You may still invest for your minor children up until the age of 18 despite their being a minimum age limit.

What is a blockchain?

A distributed database that is shared by all of the nodes in a computer network is known as a blockchain. A blockchain serves as an electronic database for storing data in digital form. The most well-known use of blockchain technology is for preserving a secure and decentralized record of transactions in cryptocurrency systems like Bitcoin. The novelty of a blockchain is that it fosters confidence without the necessity for a reliable third party by ensuring the integrity and security of a record of data.

The way the data is organized on a blockchain differs significantly from how it is typically organized. In a blockchain, data is gathered in groups called blocks that each include sets of data. Blocks have specific storage capabilities, and when filled, they are sealed and connected to the block that came before them to create the data chain known as the blockchain. Every additional piece of information that comes after that newly added block is combined into a brand-new block, which is then added to the chain once it is full.

A database typically organizes data into tables, but a blockchain, as the name suggests, strings together bits of data called “blocks.” When used in a decentralized manner, this data structure creates an irreversible time line of data by default. When a block is filled, it becomes a fixed point in time and is added to this timeline. When a block is added to the chain, it receives a precise time stamp.

How Do Cryptocurrency Mining and Bitcoin Work?

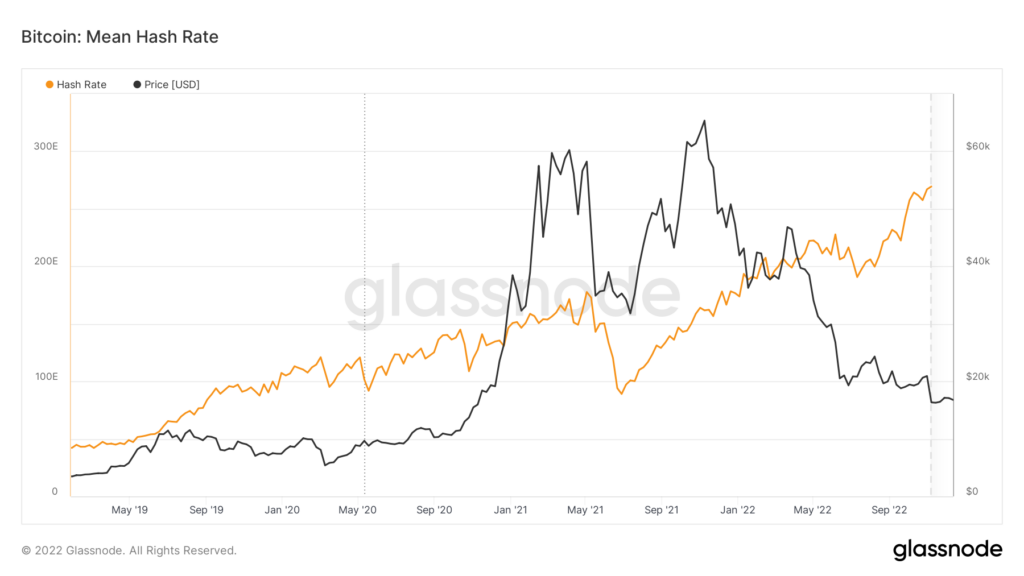

The method through which new bitcoins are placed into circulation is known as bitcoin mining. It is an essential part of the construction and maintenance of the blockchain ledger and is also how the network confirms new transactions. The process of “mining” involves employing advanced technology to tackle a very challenging computational arithmetic problem. The next block of bitcoins is distributed to the first computer to solve the issue, and the cycle repeats.

Mining for cryptocurrencies is time-consuming, expensive, and seldom profitable. However, because miners are compensated for their efforts with cryptocurrency tokens, mining has a magnetic allure for many investors who are interested in cryptocurrencies. This could be the case because businesspeople, like gold prospectors in California in 1849, perceive mining as a source of free money. And why not do it if you enjoy using technology?

What is a digital wallet?

A software-based system known as an electronic wallet (or “e-wallet”) is used to securely store the payment information and login credentials of users for a variety of websites and payment methods. Users may simply and rapidly execute transactions utilizing near-field communications technology by using a digital wallet. They can also make better passwords because they won’t have to worry about forgetting them.

Mobile payment systems, which let users pay for products using their cellphones, can be combined with digital wallets. Information from digital coupons and loyalty cards can also be stored in a digital wallet.